Step 1

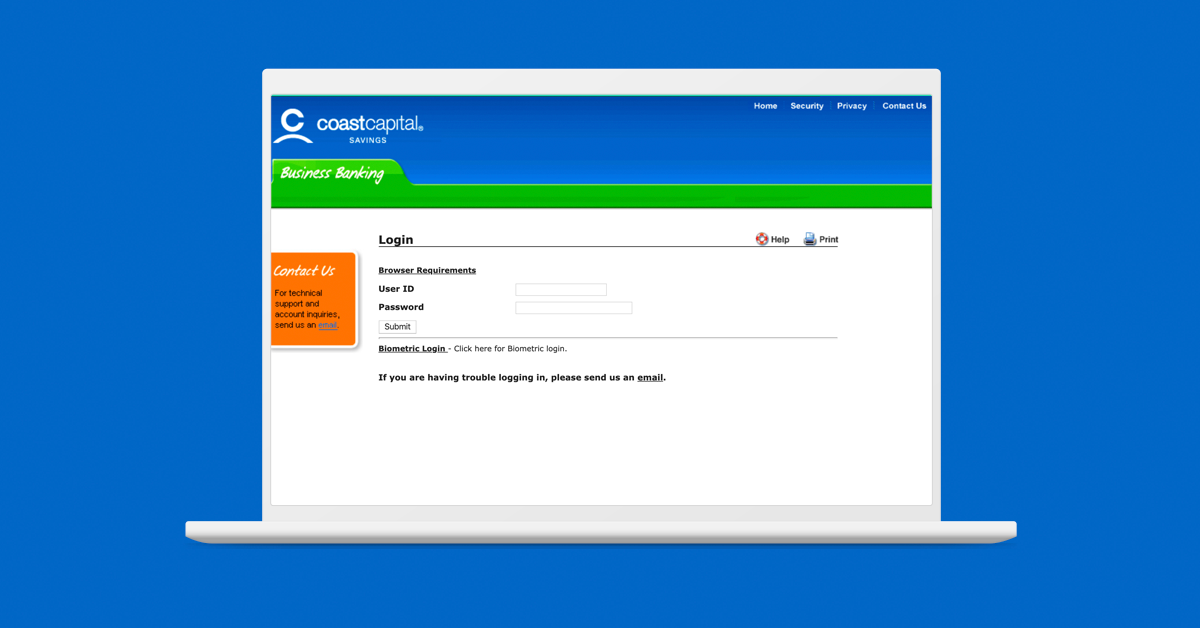

Log into Coast Online Banking for Small Business with your username and password

Step 2

Select ‘Products & Services’ from the menu

Step 3

Click on ‘Enrol for CRA Direct Deposit’

Step 4

Make sure you select the account you want the direct deposit to go into, enter your CRA business number (BN) you would like to register and accept the consent to complete enrolment. If this is for deposits from the Canada Emergency Wage Subsidy program, sign up using your CRA business number (BN) for payroll (RP).

Step 5

When you’re ready, simply hit “Submit”, and that’s it.

Step 1

Log into Coast Online Banking for Small Business with your username and password

Step 2

Select ‘Products & Services’ from the menu

Step 3

Click on ‘Enrol for CRA Direct Deposit’

Step 4

Make sure you select the account you want the direct deposit to go into, enter your CRA business number (BN) you would like to register and accept the consent to complete enrolment. If this is for deposits from the Canada Emergency Wage Subsidy program, sign up using your CRA business number (BN) for payroll (RP).

Step 5

When you’re ready, simply hit “Submit”, and that’s it.