Market-Linked GIC

Investments

Tap into the stock market with a Market-Linked GIC.

Accessing the stock market couldn't be simpler. Even if the market takes a hit, your initial investment is always safe with a Market-Linked GIC*.

Our Market-Linked GICs offer a Global Diversified GIC with a term length of 3 or 5 years.

Key features:

- Only need $500 to get started

- Choose a term length of 3 or 5 years

- Potential to earn higher returns linked to stock market performance (Eco and Global options available)

- Principal investment protected

- Available as Non-registered and Registered Account such as an RRSP or TFSA

3 Year Global Diversified and Eco Market Linked with higher potential variable return*

Features:

- Initial investment is guaranteed

- Offers a return that ranges between the guaranteed minimum return and the predetermined maximum return

- Only need $500 to get started

Best for you if:

- You're looking to keep your initial investment and grow your money conservatively

- You want to gain low-risk exposure to global stock markets

5 Year Global Diversified and Eco Market Linked with higher potential variable returns*

Features:

- Initial investment is guaranteed

- Offers a variable return that ranges between the guaranteed minimum up to the predetermined maximum.

- Only need $500 to get started

Best for you if:

- You're looking to keep your initial investment and diversify your investment portfolio

- You want to gain low-risk exposure to global stock markets

Current Offer and Past Offers

Current Offer Sale Period – March 19, 2024 - May 20, 2024

Product Name |

Issue Date | Maturity Date | Initial Index | Minimum Guaranteed Cumulative Rate of Return at Maturity | Minimum Guaranteed Annual Rate of Return | Maximum Cumulative Rate of Return at Maturity | Maximum Annual Rate of Return | ||

| 18-Jun-2024 | 18-Jun-2027 | 100 | 0.00% | 0.00% | 38.00% | 11.33% | |||

| 12-Jun-2024 | 12-Jun-2029 | 100 | 0.00% | 0.00% | 65.00% | 10.53% | |||

| 10-Jun-2024 | 10-Jun-2027 | 100 | 0.00% | 0.00% | 38.00% | 11.33% | |||

| 13-Jun-2024 | 13-Jun-2029 | 100 | 0.00% | 0.00% | 65.00% | 10.53% |

Top of main content

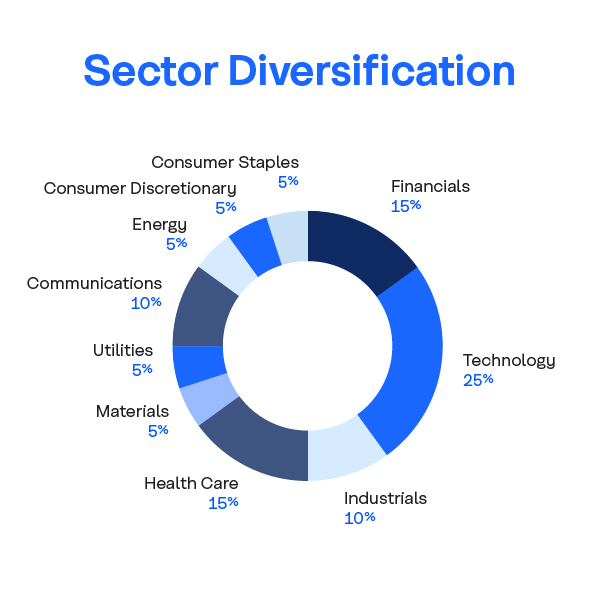

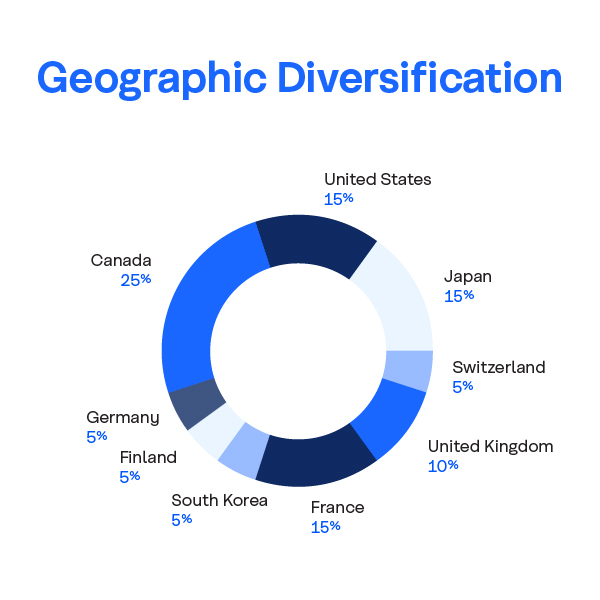

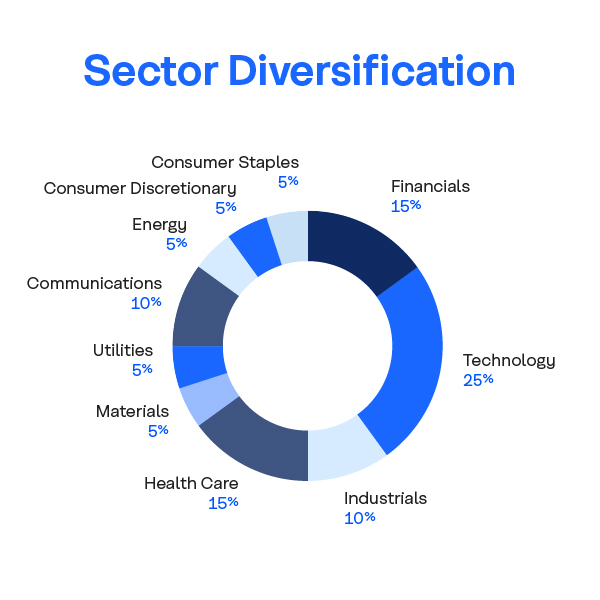

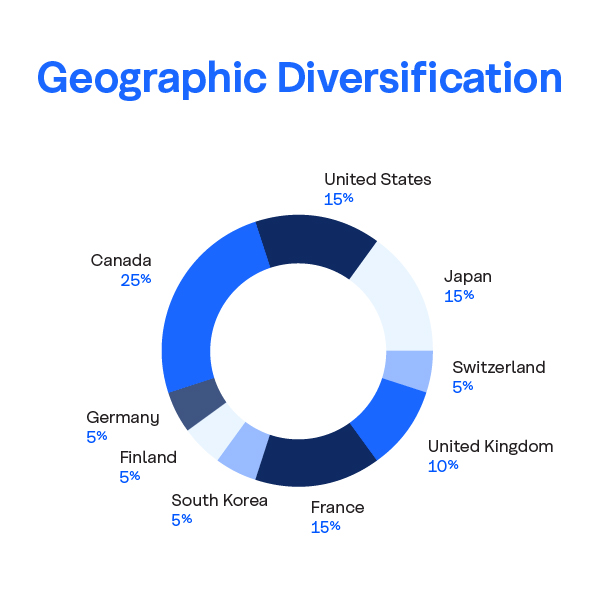

What stocks make up my Global Diversified GIC?

| Company |

|---|

| Astellas Pharma Inc |

| Bank of Nova Scotia |

| Bouygues SA |

| Cisco Systems Inc |

| Gilead Sciences Inc |

| KDDI Corp |

| Magna International Inc |

| Manulife Financial Corp |

| Neste Oyj |

| Nutrien Ltd |

| Company |

|---|

| Oracle Corp |

| Samsung Electronics Co Ltd |

| Sanofi |

| Siemens AG |

| Sony Group Corp |

| SSE PLC |

| STMicroelectronics NV |

| Swiss Re AG |

| TELUS Corp |

| Unilever PLC |

Top of main content

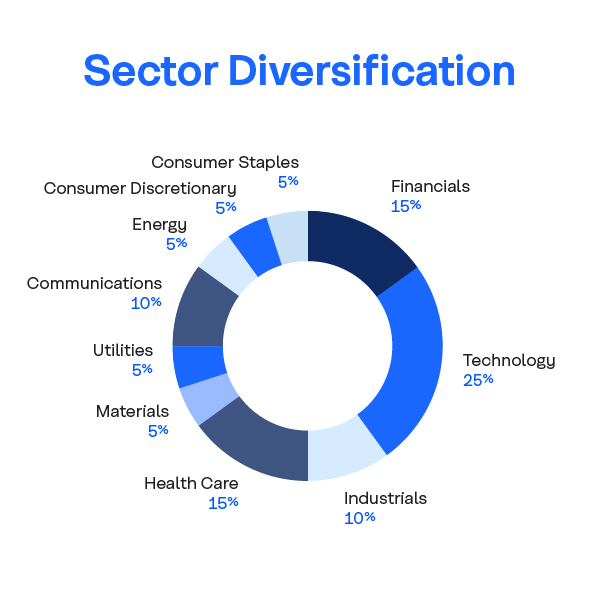

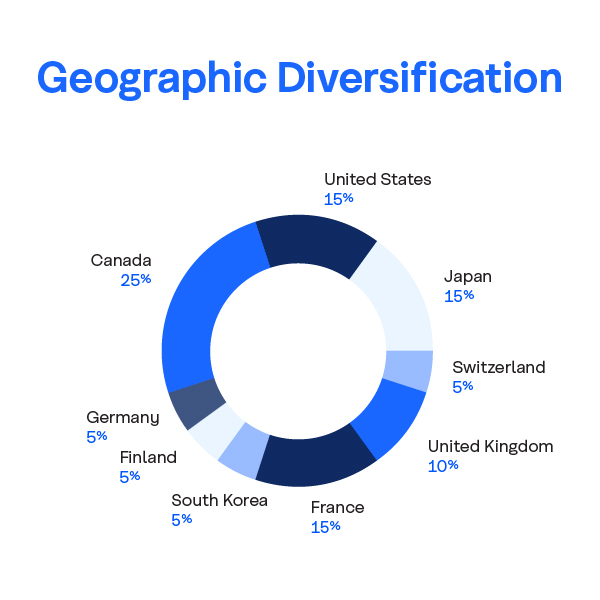

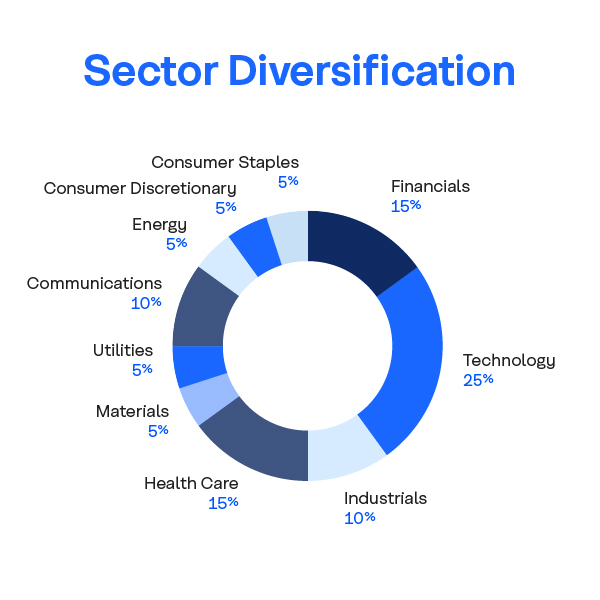

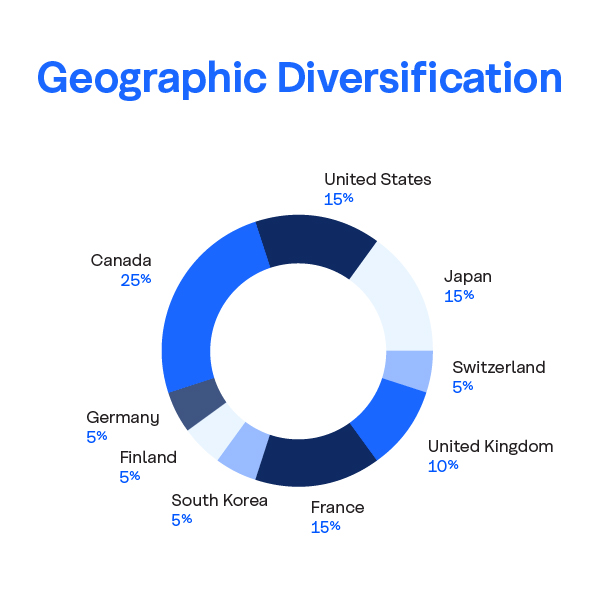

What stocks make up my Eco Market Linked GIC?

| Company |

|---|

| Alstom SA |

| Bank of Nova Scotia |

| Denso Corp |

| First Solar Inc |

| Gecina SA |

| Hydro One Ltd |

| KDDI Corp |

| Magna International Inc |

| Microsoft Corp |

| Mowi ASA |

| Company |

|---|

| Panasonic Holdings Corp |

| Novartis AG |

| Novo Nordisk A/S |

| Orsted AS |

| SAP SE |

| SolarEdge Technologies Inc |

| Texas Instruments Inc |

| Vestas Wind Systems A/S |

| Vonovia SE |

| Wheaton Precious Metals Corp |

Let’s build the right plan, together.

Our experienced Investment Team can help with an investment plan that's right for you. Call us at 1.888.517.7000 Mon-Sat, 8am-8pm; Sun, 9am-5:30pm.

Coast Capital Savings Federal Credit Union is a member of the Canada Deposit Insurance Corporation (CDIC). More CDIC information

You are now being redirected to a third party site.

The website you will be entering is not owned or operated by Coast Capital Savings Federal Credit Union or its subsidiaries. You are entering a website of an independent third party which solely owns and controls the content, products, services, and information contained on its websites. Coast Capital Savings Federal Credit Union makes no representations or warranties about the third party’s products or services and is not responsible or liable for damages relating to the third party, its products or services, its website, its privacy policies or practices, or the content of the third party website. Your use of the third party website is subject to the third party’s terms, conditions, and policies and you accept any risks and liabilities of using the third party website including, but not limited to, risks associated with data breach and loss of personal and private information.

* Variable return can only be known at maturity and may be a maximum 18.00% (5.67% per annum) for a 3 year market-linked GIC or a maximum 35.00% (6.19% per annum) for a 5 year market-linked GIC . These investments cannot be transferred or redeemed and we will not pay any interest or principal before maturity; maximum annual returns are compounded annually. Terms and conditions apply. Not available to purchase through online banking, please call us to purchase 1.844.517.7763.

For additional information, please phone our Advice Centre at 1.888.517.7000.