Explore other reasons to become a member all year round.

Learn more

How to earn 20% cashback1 on your bills.

With everything in life getting more expensive, we want to help you keep more of your cash for the things you need.

Become a member and follow the steps below to earn cashback on your household bills.

Step 1: Become a member in as little as 5 minutes online.

By opening a Free Chequing, Free Debit, and More Account® with no monthly balance required.

- No monthly fee

- Unlimited day-to-day transactions3

- Save an annual average of up to $200 compared to other financial institutions.4

- Click here for service fees on services that are not included with this account.

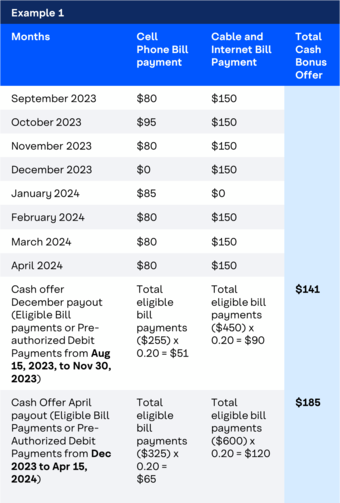

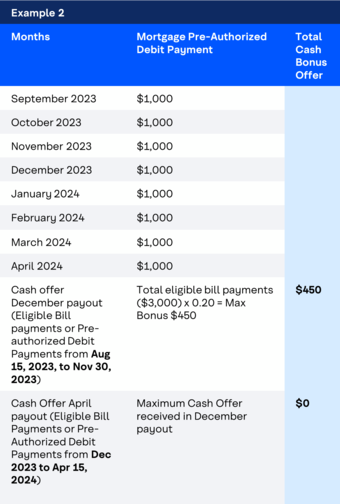

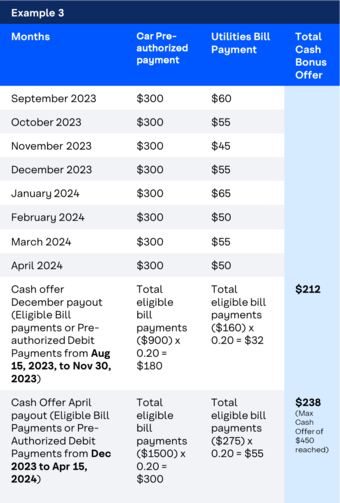

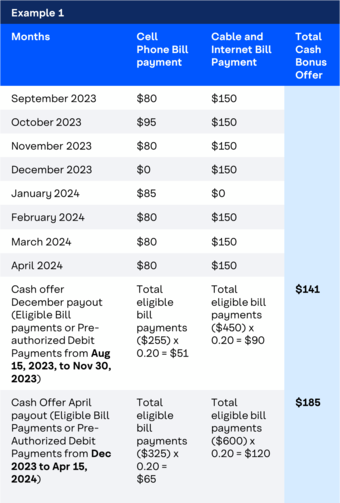

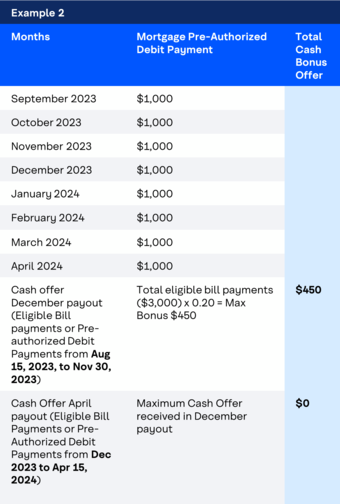

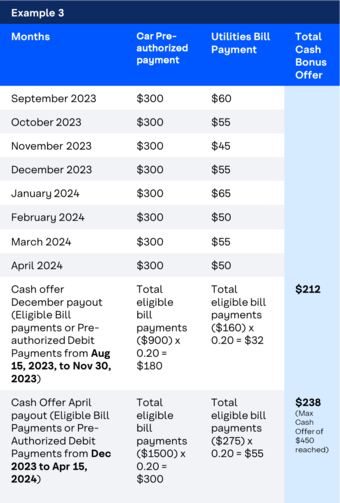

Step 2: Start earning 20% cashback1 on your household bills, up to a maximum cashback bonus of $450.

Within the first 60 days after account opening:

- Make eligible1 bill payments or set-up pre-authorized debits

See FAQs section for links on how to make and set up bill payments and pre-authorized debits. that recur for 3 consecutive months or more.

See FAQs section for links on how to make and set up bill payments and pre-authorized debits. that recur for 3 consecutive months or more.  20% cashback will be received after the payment has successfully cleared your chequing account for at least 3 consecutive months, to the same bill provider Each payment must be at least $25.

20% cashback will be received after the payment has successfully cleared your chequing account for at least 3 consecutive months, to the same bill provider Each payment must be at least $25.

Earn cashback on payments like utilities, cell phone, cable, mortgage, property tax, insurance, strata, gym memberships, car payments and more.

Credit card payments are not eligible for this offer. See full list of exclusions in FAQ section below.

As a member, you’re helping to build better futures for all Canadians.

Member-owned for over 80 years, we believe our financial cooperative is an engine for good. It’s why for every new member, we’ll donate $150 to the Youth Futures Education Fund2, to help former youth in care with their living expenses as they pursue their post-secondary dreams.

This offer is only available to new, personal members who are residents of British Columbia. See terms and conditions.

- Make one or more eligible bill payments and/or set-up one or more eligible pre-authorized debits, for a minimum period of 3 consecutive months. Each bill payment or pre-authorized debit payment must be at least $25.

- 20% cashback will be received after the payment has successfully cleared your chequing account monthly for at least 3 consecutive months, to the same bill or pre-authorized debit payee.

- To get the full maximum cashback bonus of $450, the new member will have needed to make $2,250 in eligible payments. The longer the recurring payment is in the account, the more cashback the member can earn, up to $450.

Eligible household bill and pre-authorized debit payment categories include utilities, phone provider, cable provider, child care, gym memberships, strata payments, property tax, mortgage, insurance, car payments, tuition, etc.

Only the following bill payment and pre-authorized debit categories are excluded: Any and all payments made to a Credit Card, PayPal, International Money Transfer Services (e.g., Wise or Western Union), short term/pay-day loans (e.g., National Money Mart, Cash Money Cheque, or Money Tree Canada), or any and all payments made via Interac® e-Transfer.

Pre-authorized payments to savings or wealth accounts are also excluded.

As a financial cooperative, all Coast Capital members are owners.

Join us and experience the difference a real financial partner makes.

Apply online in as little as 5 minutes.

- Up to a maximum cashback bonus of $450. Read full New Member Cashback Offer terms and conditions here. The following bill payment and pre-authorized debit payment categories are ineligible and excluded from the offer: Any and all payments made to a Credit Card, PayPal, International Money Transfer Services (e.g., Wise or Western Union), short term/pay-day loans (e.g., National Money Mart, Cash Money Cheque, or Money Tree Canada), or any and all payments made via Interac® e-Transfer.

- Up to a maximum donation of $150,000 from August 15 – November 30, 2023.

- Transactions include cheques, Coast Capital Savings® and EXCHANGE Network ATM withdrawals, Interac® Direct Payment, preauthorized payments, Coast-by-Phone® bill payments, Coast Online® Banking bill payments and in-branch withdrawals, transfers and bill payments. Deposits and self-serve (Coast Capital Savings® ATM, Coast-by-Phone® and Coast Online® Banking) transfers are free.Additional network ATM transactions are subject to the fees listed. Surcharges from other financial institution ATMs are excluded.

- Fee savings based on comparisons to average fees on chequing products charged by other Canadian financial institutions.