Market-Linked GIC

Tap into the stock market with a Market-Linked GIC

Accessing the stock market couldn't be simpler. Even if the market takes a hit, your initial investment is always safe with a Market-Linked GIC.

Our Market-Linked GICs offer a Global Diversified and Responsible GIC with a term length of three or five years.

Key features:

- Only need $500 to get started

- Choose a term length of three or five years

- Potential to earn higher returns linked to stock market performance (global diversification and Responsible options available)

- Principal investment protected

- Available as non-registered and registered Account, such as an RRSP or TFSA

Three-Year Global Diversified and Responsible Market Linked with higher potential variable return*

Features of Three-Year Global Diversified and Responsible Market Linked:

- Initial investment is guaranteed

- Offers a return that ranges between the guaranteed minimum and the predetermined maximum

- Only need $500 to get started

Three-Year Global Diversified and Responsible Market Linked is Best for you if:

- You're looking to keep your initial investment and grow your money conservatively

- You want to gain low-risk exposure to global stock markets

Five-Year Global Diversified and Responsible Market Linked with higher potential variable returns*

Features of Five-Year Global Diversified and Responsible Market Linked:

- Initial investment is guaranteed

- Offers a variable return that ranges between the guaranteed minimum up to the predetermined maximum

- Only need $500 to get started

Five-Year Global Diversified and Responsible Market Linked is Best for you if:

- You're looking to keep your initial investment and diversify your investment portfolio

- You want to gain low-risk exposure to global stock markets

Current offer and past offers

Product Name |

Issue Date | Maturity Date | Initial Index | Minimum Guaranteed Cumulative Rate of Return at Maturity | Minimum Guaranteed Annual Rate of Return | Maximum Cumulative Rate of Return at Maturity | Maximum Annual Rate of Return |

| 20-Feb-2026 | 20-Feb-2029 | 100 | 3.00% | 0.99% | 15.00% | 4.77% | |

| 13-Feb-2026 | 13-Feb-2031 | 100 | 5.00% | 0.98% | 35.00% | 6.19% | |

| 23-Feb-2026 | 23-Feb-2029 | 100 | 3.00% | 0.99% | 15.00% | 4.77% | |

| 18-Feb-2026 | 18-Feb-2031 | 100 | 5.00% | 0.98% | 35.00% | 6.19% |

From January 24 2023 to June 25 2025 the Responsible Market-Linked product was named Eco Market-Linked GIC

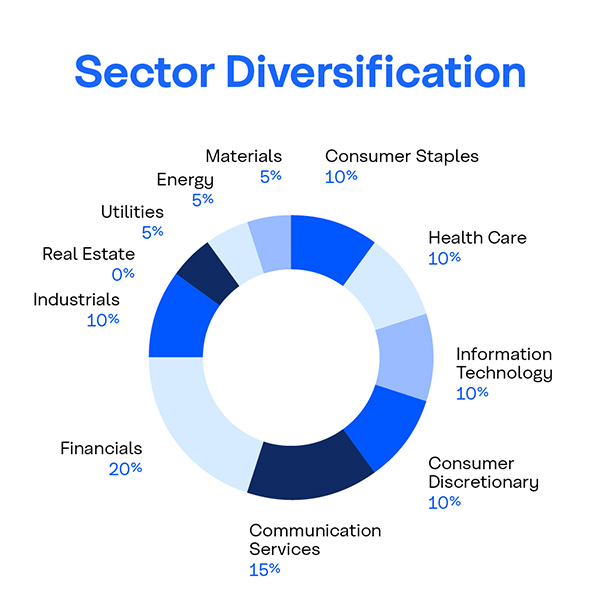

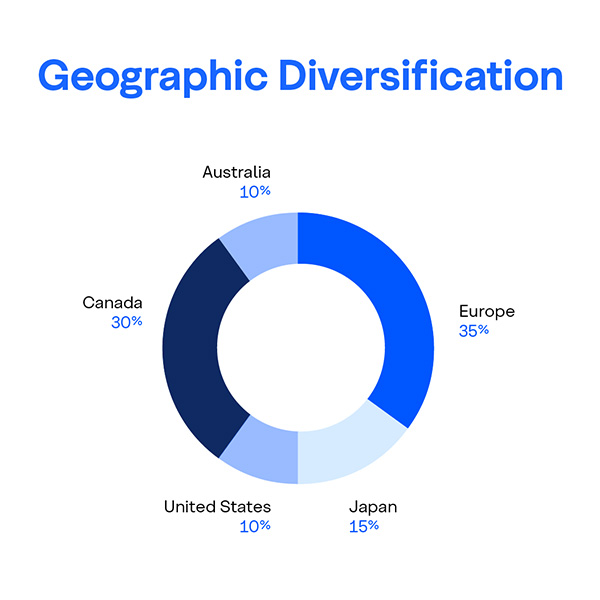

What stocks make up my Global Diversified GIC?

| Company |

|---|

| BCE Inc |

| TELUS Corp |

| Verizon Communications Inc |

| Danone |

| Coles Group Ltd |

| Magna International Inc |

| Kawasaki Kisen Kaisha Ltd |

| Enbridge Inc |

| Michelin (CGDE) |

| Holcim Ltd |

| Company |

|---|

| Bank of Nova Scotia |

| Intesa Sanpaolo |

| Sumitomo Mitsui Trust Group |

| DNB Bank ASA |

| APA Group |

| Sanofi SA |

| Astellas Pharma Inc |

| Shopify Inc |

| Intl Business Machines Corp |

| AP Moller-Maersk A/S-B |

What stocks make up my Responsible Market Linked GIC?

| Company |

|---|

| First Solar Inc |

| Vestas Wind Systems A/S |

| Orsted AS |

| Holmen AB |

| Salmar ASA |

| Brookfield Renewable Partners LP |

| Gecina SA |

| First Capital Real Estate Investment Trust |

| Redeia Corp SA |

| UPM-Kymmene Oyj |

| Company |

|---|

| Terna-Rete Elettrica Naziona |

| Boralex Inc-A |

| Daiwa House Industry Co Ltd |

| Hewlett Packard Enterprise Co |

| Kubota Corp |

| East Japan Railway Co |

| Intel Corp |

| Schneider Electric SE |

| West Fraser Timber Co Ltd |

| Xylem Inc/NY |

Frequently-Asked Questions (FAQs)

Responsible investment is an approach which incorporates Environmental, Social, and Governance factors into investment decisions.

Responsible investment approaches inform how we select our Responsible Market-Linked GICs. A rigorous selection process involving detailed financial analysis, exclusionary screening, ESG assessment, and a final selection of stocks are completed.

The selection process for Responsible Market-Linked GICs involves a four-step process:

- Financial Analysis: Qualified Investment Managers analyze companies based on in-depth financial data.

- Exclusionary Screening: Companies involved in controversial activities (e.g. weapons production, tobacco) are screened out.

- ESG Assessment: The remaining companies are evaluated against Environmental, Social, and Governance criteria.

- Final Selection: Investment managers review the remaining companies and select those with the strongest financial outlook.

Exclusionary screening involves the use of specific criteria to exclude companies involved in major controversies or primarily active in industries that are deemed harmful, including industries involving weapons, tobacco, nuclear power production and fossil fuels.

Connect with us

Coast Capital Savings Federal Credit Union is a member of the Canada Deposit Insurance Corporation (CDIC). More CDIC information

Only deposits payable in Canada are eligible to be insured under the Canada Deposit Insurance Corporation Act.

You are now being redirected to a third party site.

* Variable return can only be known at maturity and may be a maximum 17.00% (5.37% per annum) for a 3 year market-linked GIC or a maximum 35.00% (6.19% per annum) for a 5 year market-linked GIC . These investments cannot be transferred or redeemed and we will not pay any interest or principal before maturity; maximum annual returns are compounded annually. Terms and conditions apply. Not available to purchase through online banking, please call us to purchase 1.844.517.7763.

For additional information, please phone our Advice Centre at 1.888.517.7000.