Build your financial future automatically.

Get $1001 when you set up regular, automatic contributions into mutual funds with Coast Capital. A little can go a long way and it’s easy to get started. Lessen the impact of market highs and lows on your mutual funds when you invest the same amount regularly with “dollar-cost averaging.”

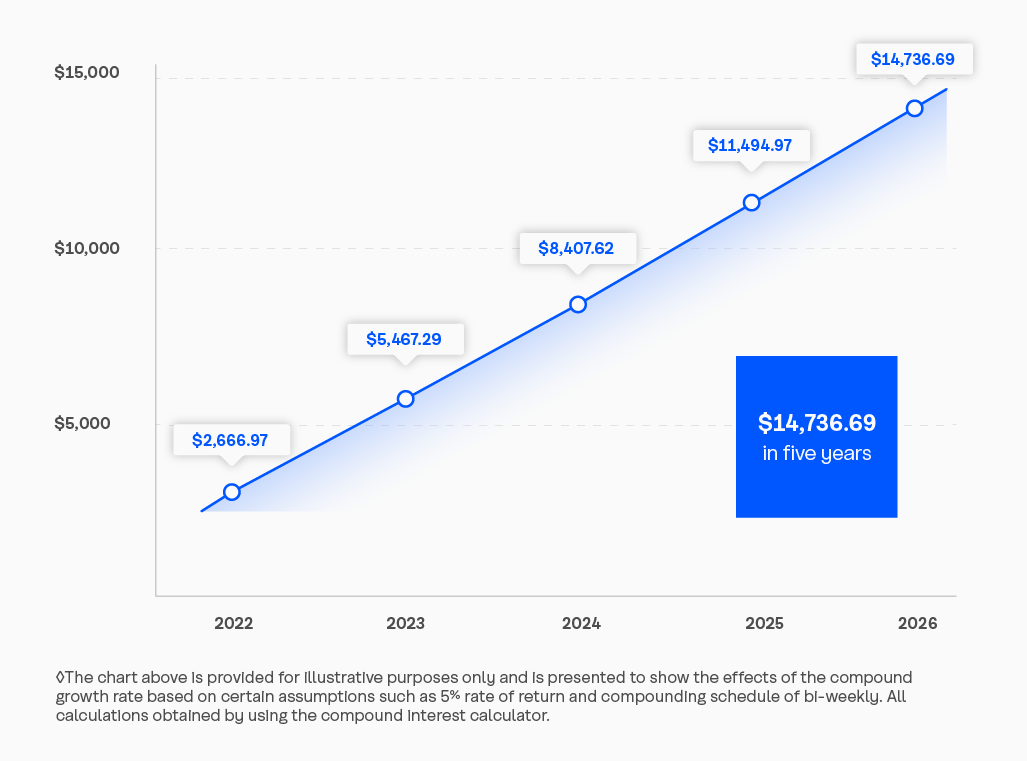

Plus, saving through regular contributions over time gives you the benefit of compound interest – where you earn interest on your initial investment and you earn interest on your interest. That means if you invest $100 every two weeks into a balanced investment, assuming a consistent 5% return, your investment could grow to over $14,000 in just 5 years.◇

Build your financial future automatically.

Get $1001 when you set up regular, automatic contributions into mutual funds with Coast Capital. A little can go a long way and it’s easy to get started. Lessen the impact of market highs and lows on your mutual funds when you invest the same amount regularly with “dollar-cost averaging.”

Plus, saving through regular contributions over time gives you the benefit of compound interest – where you earn interest on your initial investment and you earn interest on your interest. That means if you invest $100 every two weeks into a balanced investment, assuming a consistent 5% return, your investment could grow to over $14,000 in just 5 years.◇