Tips for your cyber-smart routine

- Create strong online banking passwords and email passwords, and update them every 2-3 months.

- Don’t share your login information with anyone, even if they claim to be a representative of Coast Capital. We will never ask you for that information by email, text or phone

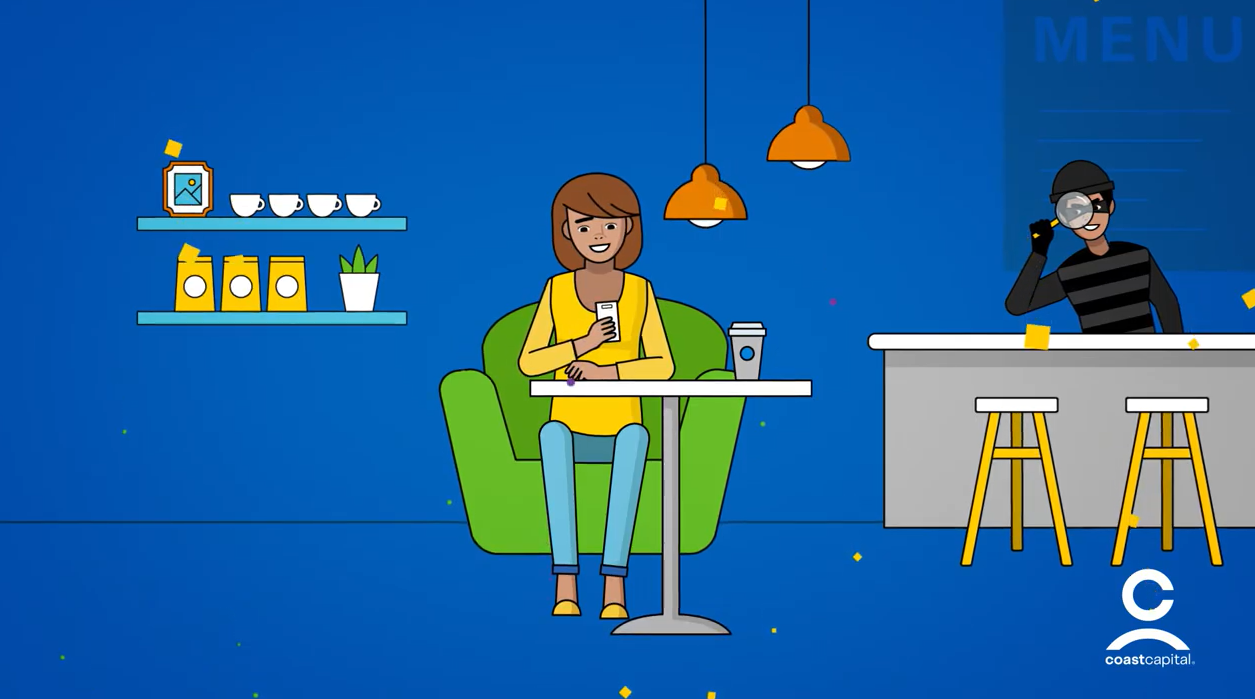

- Avoid banking on public Wi-Fi. Public Wi-Fi services are not secured. If you need to access online banking when outside your home, it’s safest to use your data

- Make sure your financial institution takes security seriously. Like us. We’ve invested in technology that’s designed to help protect your account – including proactive fraud detection, two factor authentication, and security alerts.

- Keep a close eye on your accounts, and report anything that doesn’t look quite right immediately to your financial institution.

Tips for your cyber-smart routine

- Create strong online banking passwords and email passwords, and update them every 2-3 months.

- Don’t share your login information with anyone, even if they claim to be a representative of Coast Capital. We will never ask you for that information by email, text or phone

- Avoid banking on public Wi-Fi. Public Wi-Fi services are not secured. If you need to access online banking when outside your home, it’s safest to use your data

- Make sure your financial institution takes security seriously. Like us. We’ve invested in technology that’s designed to help protect your account – including proactive fraud detection, two factor authentication, and security alerts.

- Keep a close eye on your accounts, and report anything that doesn’t look quite right immediately to your financial institution.